P3 - NEWS

Additive manufacturing industry optimistic despite challenges

“Our member companies continue to demonstrate remarkable stability and adaptability in a changing market environment,” explains Dr. Markus Heering, Managing Director of the VDMA Additive Manufacturing Working Group. The working group's spring 2025 survey shows that the additive manufacturing industry remains optimistic despite some challenges. The survey was conducted until March 28, i.e. before the US tariffs were introduced. One result is that more companies reported positive sales than in the previous fall survey. Nevertheless, 34 percent of companies reported declining sales for the last 12 months. In the past 6 months, however, the negative turnover of member companies was only 20 percent. “We are therefore seeing a slight trend towards more positive business,” explains Dr. Heering.

Industry expects further growth

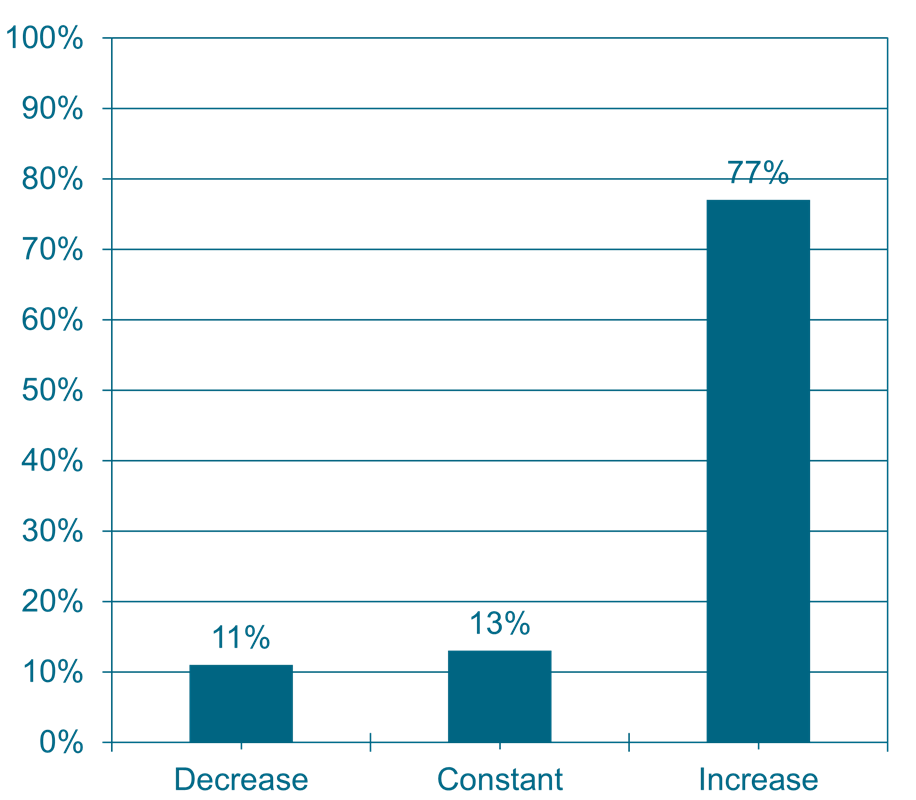

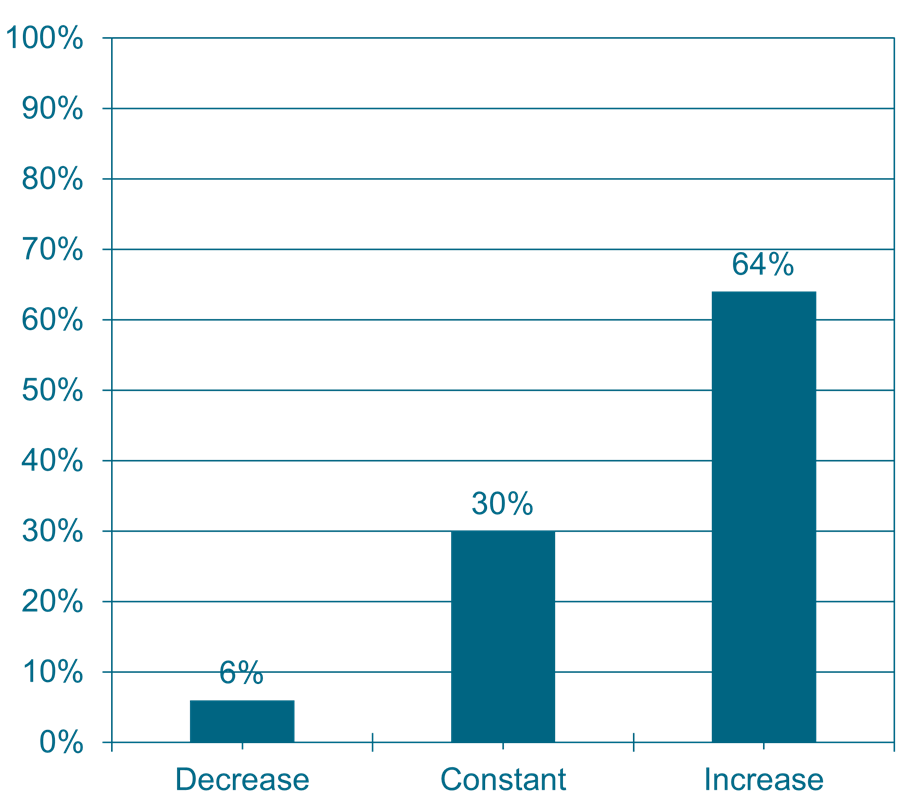

Optimism remains at a high level and has even increased further in the last six months. Looking ahead to the next 24 months, 77% of respondents expect growth in the domestic market. In terms of exports, 64% of our member companies expect an increase over the next 24 months - in contrast to 58% in the fall survey last year.

The EU-27 is the most important export region for almost 70% of member companies, followed by the USA (64%) and European non-EU countries (29%). “We are observing the great importance of the USA as an export market. The future will show how exports to the USA will change in the future,” explains the managing director of the working group.

The most relevant competitors come from China and the USA. Almost half of the member companies have Chinese additive manufacturing competitors, while 43% see themselves in competition with American additive manufacturing providers. “We are even seeing a slight increase here compared to the previous survey. Competition from China is becoming more and more noticeable,” Dr. Heering sums up.

Investments pick up speed again

Despite the generally difficult economic situation, many companies want to invest more again. Next year, 40 percent plan to spend more money on investments. The most positive effect on the additive manufacturing business will come from technological developments (60%), followed by new applications and new markets. One in five companies also hopes that research and development activities will provide positive impetus in the current year.

“This is where we can make a targeted start. Our working group brings together a large number of players who offer products and services along additive process and value chains,” says Dr. Heering. Members include additive manufacturing machine manufacturers and their suppliers, machine manufacturers for post-processing, as well as additive manufacturing service providers and manufacturers of additive components for in-house use. There are also research institutes as well as software and material providers. The composition of the member companies is very heterogeneous. Nevertheless, there is broad agreement on the areas in which the additive manufacturing industry needs to improve.

Positive impetus through stable processes and reduced costs

“We require process stability and reproducibility and have to work on these topics. We also need focus on the cost level to increase the competitiveness of additive manufacturing. Furthermore, it is important to develop new technologies with a focus on series production. Finding new industrial applications will help us to increase market acceptance,” summarizes Dr. Heering.

The continuous exchange between the member companies in the VDMA working group is proving to be particularly valuable. It makes it possible to discuss challenges, solutions and best practices across all process, material and discipline boundaries. This provides valuable suggestions and starting points.

Both manufacturers and users from the metal and plastics sectors are represented in the working group. They develop and use both direct and indirect additive manufacturing processes to produce series products, prototypes, assembly aids and much more. “Our members regularly discuss topics along the entire additive process chain and share their perspectives and experiences. This improves our understanding of current tasks and challenges, which gives us a clearer picture of development needs along the value chain and, as an industry, advances the industrialization of additive manufacturing,” explains the managing director of the working group.